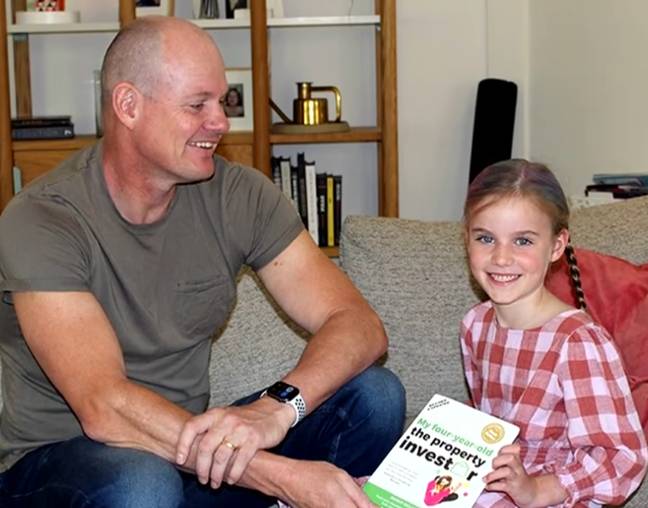

After purchasing a property at the age of six, an 8-year-old girl has become one of the youngest homeowners in history.

You read correctly: Australian Ruby McLellan, along with her two siblings, Angus, 14, and Lucy, 13, purchased their first house jointly, making her the youngest homeowner in the nation.

The threesome paid $671,000 for the four-bedroom property in Clyde, Victoria, two years ago, and it is currently valued at $960,000.

Now that you know why it all started so early, the three siblings put a lot of effort into saving up a $6,000 deposit by helping their father pack his book about real estate investing and completing household duties. With the support of both of their parents, they were able to buy a property.

According to a Daily Mail report, they are already on pace to buy their next investment home with all of their names as owners utilising the equity in the current house’s mortgage.

Ruby told the source that although she finds it “pretty cool” that she’s accomplished this at such a young age, she’s keeping it a secret from her schoolmates for the time being.

In the hopes that they’ll be able to utilise it wisely in the future, their father, Cam, the CEO of the real estate investment firm OpenCorp, said he taught his kids the fundamentals of investing.

“In ten years time when our kids might start looking to buy their own homes, the deposits are going to be $200,000,” he stated. “There’s no way kids of today are going to be able to afford a home without help from mum and dad.”

He went on to say: “We have four kids and might need to fork out $800,000, so the obvious thing to do is to use one small deposit now, buy a property, let it double in value and then sell it.”

The family stated that they intend to hold onto the property until Lucy and Angus are in their early 20s, meaning that they will have experienced one “full growth property cycle,” as Cam refers to it. They also estimate that the property is worth about $1 million, which will allow each of their children to receive some assistance when the time comes for them to purchase their own homes.

“Historically every 7 to 10 years property doubles in value,” Cam said. “I’ve been investing for 30 years and now is a great time to invest based on inflation decreasing and the prediction of interest rate drops.”

In their early 20s, Cam and his wife Felicity bought their first home together with the intention of becoming “financially free,” and they have succeeded in doing so.

The property investor only works a handful of hours every week to maintain his cash flow and now he has more time to spend with his wife and kids.

“In the first few years Felicity and I bought existing builds, but with new builds you can get the perfect property in any area plus hone in on the right design and depreciation is the greatest at the start,” Cam explained before adding: “And tenants prefer new builds over existing ones – there’s so many advantages.”

So there we have it guys, take those tips from Cam and see how it works for you. But then again, I guess it only works if you have a rich daddy to float the foundations of the project.